How to Open Your First Mutual Fund Account (with Just ₦5,000)

🟩 Discover the beginner-friendly steps to start investing in mutual funds with minimal capital in Nigeria. Make your money work for you — even if you’re starting small.

Introduction: Why Mutual Funds Could Be the Smartest First Investment You Ever Make

Can ₦5,000 really make a difference in your financial future?

If you’re like most Nigerians, you’ve probably been told you need hundreds of thousands — or even millions — to start investing. That’s a myth. In 2025, opening a mutual fund account in Nigeria is not only easy, it’s accessible to almost anyone. You don’t need to be a financial expert, and you certainly don’t need to break the bank.

With inflation on the rise and traditional savings accounts offering poor returns, more Nigerians — including students, side hustlers, and salary earners — are turning to mutual funds as a smart, low-risk way to grow their wealth.

In this guide, I’ll walk you through everything you need to know to confidently open your first mutual fund account — even if all you’ve got is ₦5,000 in hand.

📑 Table of Contents

- What is a Mutual Fund?

- Why Mutual Funds Matter in 2025

- Case Study: How Ada Grew ₦10K to ₦140K in 2 Years

- Step-by-Step Guide to Opening a Mutual Fund Account in Nigeria

- Step 1: Understand Your Investment Goal

- Step 2: Choose a Trusted Asset Management Company

- Step 3: Select the Right Type of Fund

- Step 4: Register and Fund Your Account

- Step 5: Track, Grow, and Reinvest

- Step 1: Understand Your Investment Goal

- 7 Common Mistakes to Avoid as a New Investor

- Top Mutual Fund Platforms and Apps in Nigeria (2025)

- More Real-Life Examples and Testimonials

- Final Thoughts: Small Money, Big Mindset

- FAQs

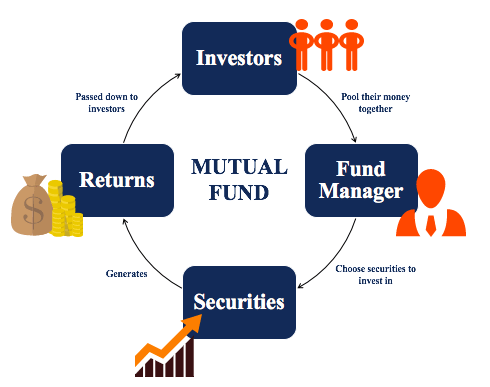

What is a Mutual Fund?

A mutual fund is a pooled investment vehicle where many individuals contribute money, which is then professionally managed and invested in a diversified portfolio — including stocks, bonds, treasury bills, and real estate instruments.

🔍 Origin and Basics

Mutual funds were introduced in Nigeria in the 1990s but gained mass popularity in the 2010s as internet access and fintech innovation increased. Today, mutual funds are regulated by the Securities and Exchange Commission (SEC) of Nigeria, ensuring your money is secure and monitored.

🆚 How They Compare to Other Investment Options

| Investment Option | Capital Required | Risk Level | Returns (2024 avg) |

| Fixed Deposit | ₦50,000+ | Low | 6–9% annually |

| Treasury Bills | ₦100,000+ | Low | 7–10% |

| Mutual Fund | ₦5,000+ | Medium-Low | 10–18% |

| Stocks | ₦5,000+ | Medium-High | 12–25%+ |

Why Mutual Funds Matter in 2025

With rising inflation (averaging over 29% in early 2025) and a weakening naira, keeping your money in a savings account is like watching it shrink every month.

🔢 Current Data & Trends

- Over ₦1.5 trillion is now invested in Nigerian mutual funds (SEC Nigeria, 2024)

- Over 40% of new retail investors in Nigeria began with mutual funds (Chapel Hill Denham)

- Some money market funds returned up to 15% annually in 2024

💡 Mutual Funds Solve Key Problems:

- ✅ Beat inflation

- ✅ Easy to start

- ✅ No financial experience needed

- ✅ Withdrawable anytime (in most funds)

Case Study: How Ada Grew ₦10K to ₦140K in 2 Years

👩💼 Who is Ada?

Ada, a 27-year-old secondary school teacher in Ibadan, started investing ₦10,000 monthly in a money market fund from ARM in early 2023.

📈 What She Did

- Chose a low-risk fund

- Used auto-debit to invest monthly

- Reinvested interest for compounding

📊 The Results

After 24 months, she had grown her investment to ₦140,000+, outperforming savings accounts by over 200%.

💬 “I used to think investing was for rich people. Now, I teach my students what I wish I knew earlier.” – Ada, mutual fund investor

Step-by-Step Guide to Opening a Mutual Fund Account in Nigeria

### ✅ Step 1: Understand Your Investment Goal

Ask yourself:

- Am I saving for something short-term (like rent)?

- Or am I investing long-term (retirement, property, etc.)?

🔹 Short-term → Go for money market or fixed income funds

🔹 Long-term → Consider balanced or equity funds

✅ Step 2: Choose a Trusted Asset Management Company

Here are some of Nigeria’s most trusted SEC-registered fund managers:

- ARM Investment Managers

- Stanbic IBTC Asset Management

- Meristem Wealth

- FBNQuest

- Chapel Hill Denham

Always verify on the SEC’s official website.

✅ Step 3: Select the Right Type of Fund

| Fund Type | Ideal For | Risk Level | Typical Return |

| Money Market Fund | Capital preservation | Low | 10–14% |

| Fixed Income Fund | Stable returns | Low-Medium | 12–16% |

| Balanced Fund | Moderate growth | Medium | 14–20% |

| Equity Fund | High growth, long term | High | 18–25%+ |

✅ Step 4: Register and Fund Your Account

You’ll need:

- A valid ID (NIN, voter’s card, or driver’s license)

- Utility bill (for address verification)

- Bank account (preferably with BVN)

Most platforms (like Cowrywise, Bamboo, or ARM’s website) let you register 100% online.

📲 Fund via:

- Debit card

- Bank transfer

- Auto-debit (monthly contributions)

✅ Step 5: Track, Grow, and Reinvest

You can:

- Track growth via mobile app or email statements

- Reinvest dividends for compound growth

- Withdraw at any time (usually within 24–72 hours)

❌ 7 Common Mistakes to Avoid

- Starting without a goal

Solution: Define your time horizon before investing. - Ignoring fund fees and charges

Solution: Read the prospectus and know what’s deducted. - Following hype instead of facts

Solution: Stick to funds with a 3–5 year performance record. - Withdrawing too early

Solution: Give your fund time to grow — think long-term. - Not diversifying

Solution: You can split across 2–3 different funds. - Skipping due diligence

Solution: Only use SEC-registered fund managers. - Forgetting to reinvest

Solution: Turn on auto-reinvestment where possible.

📱 Top Mutual Fund Platforms and Apps in Nigeria (2025)

| Platform | Features | Min Investment | Pros | Cons |

| Cowrywise | Mobile-first, beginner-friendly | ₦1,000 | Easy UI, auto-save | Limited fund options |

| ARM Direct | Direct from fund manager | ₦5,000 | Variety of funds | Slower app |

| Bamboo | Dollar & local funds | ₦5,000 | Diversification | Some fees apply |

| Trove | App-based investing | ₦1,000 | Multi-asset support | UI can be complex |

| Stanbic IBTC App | Trusted bank name | ₦5,000 | Stability | Fewer retail tools |

📊 More Case Studies and Testimonials

💬 “I started with ₦5,000, now I invest ₦20,000 monthly. The growth is addictive.” – Kelechi, 33, Lagos

💬 “Even during naira fluctuations, my ARM money market fund kept growing.” – Chika, UI/UX Designer

💬 “I use Cowrywise to fund 3 different funds. Easy and automated.” – Ayodele, freelancer

🧠 Final Thoughts: Small Money, Big Mindset

Starting small is not a weakness — it’s a superpower.

Every successful investor began somewhere, and many began with far less than they wanted to. Mutual funds let you step into the world of investing with minimal risk, maximum learning, and long-term growth potential.

Your ₦5,000 can either sit idle or start working today. The choice is yours.

❓ Frequently Asked Questions (FAQs)

Q: Can I really start investing in mutual funds with ₦5,000?

Absolutely. Many top fund managers accept a minimum investment of ₦5,000 or less. Some apps like Cowrywise allow ₦1,000 to get started.

Q: Are mutual funds safe in Nigeria?

Yes — as long as the fund manager is registered with the Securities and Exchange Commission (SEC) and your chosen fund has a verifiable track record.

Q: Which mutual fund is best for beginners?

For low-risk and short-term goals, start with a money market fund. They’re stable and offer decent returns.

Q: How do I make money from mutual funds?

You earn from dividends and capital appreciation. Some funds pay you monthly or quarterly; others grow in value over time.

Q: Can I withdraw my money anytime?

Most mutual funds allow withdrawal within 1–3 working days. However, it’s best to invest with a medium to long-term mindset.

Q: Is it better to invest monthly or one-time?

Monthly investing (also called dollar-cost averaging) helps reduce risk and build discipline. Start small, then increase as you go.

Q: Are mutual fund returns guaranteed?

No. Returns depend on the fund’s performance and market conditions. That’s why choosing a reputable manager is key.

I'm Abraham Itunnu An Entrepreneur, Forex Trader, Writer, Web Designer. Please this website is not a Get Rich Quick Scheme. You need to put things to work so acheive good results.

Click Here To Learn The Exact Steps

Recent Posts

- How to Scale Your AI Side Hustle to ₦200,000+ Per Month in Nigeria (2026 Guide)

- Step-by-Step Guide to Making Your First ₦50,000With AI (2026 Edition)

- How to Use ChatGPT to Make Money in Nigeria (2026 Guide)

- 5 Ways Nigerians Can Earn in Dollars Using AI Tools (2026 Guide)

- How Students & Side Hustlers Can Use These AI Tools to Make Money in 2026